The cost of borrowing significantly increased for both individuals and the Government after the Central Bank of Kenya (CBK) tightened its monetary policy to tame inflation.

According to the Parliamentary Budget Office 2023 report, there was an rise in the cost of short-term borrowing despite the little change in the lending rate.

Moreover, the report stated that despite the increase in the recorded rate of savings by Kenyans, the monetary policy posed a risk to the savings.

The report explained that Kenyans were forced to spend a higher proportion of their income on daily consumption, causing them to save less and less.

Speaking to Kenyans.co.ke, on Monday, February 13, Economist XN Iraki explained that Kenyans were reluctant to borrow because it was difficult to repay debts.

Prof Iraki, a lecturer at the University of Nairobi stated that because of the difficult economic times, many individuals were earning less and buying more making it difficult for them to pay loans.

“We borrow to invest and get money to repay. If the economic prospects are not bright, we are reluctant to borrow,” Iraki stated.

Addressing the challenges of saving, the university don stated that Kenyans were discouraged to save because it meant that their money lost value, encouraging more spending.

“Savings are discouraged by inflation because your money loses value and you would rather spend it than keep it,” Iraki noted.

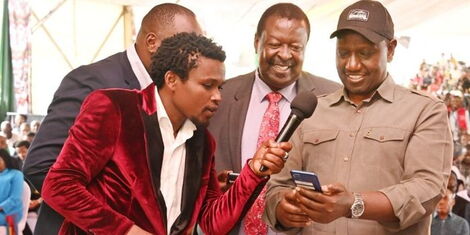

President William Ruto on Friday, February 3 reiterated the need for a saving culture, noting that the Hustler Fund was initiated to ensure that Kenyans were able to save and borrow for economic empowerment.

The Head of State further announced that the government would issue credit scores to borrowers of the Hustlers Fund so that borrowers with a higher score will see their limit increased.

“Some of you will even access double of what you have been accessing, some of you will access an additional 80 percent of what you have been accessing,” Ruto stated.

Source: kENYANS.CO.KE