Kenyans are set to dig deeper into their pockets to buy homes after a High Court ruling barred Kenyans from purchasing residential property with pension savings.

Through Justice Anthony Ndung’u, the High Court ruled that the amendment to the Morgage Loans Amendment Regulations 2020 was unlawful.

In the ruling made on Wednesday, November 23, Parliament was found to have failed to involve the public before passing the bill.

He added that the amendment was sneaked in without going through the requisite procedure as prescribed by the law.

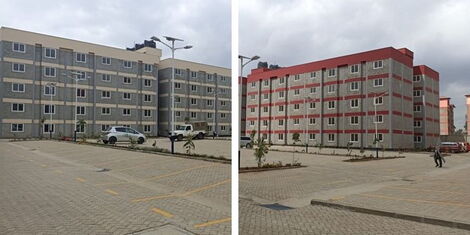

The recent development may hinder the government’s plan to offer affordable housing to Kenyans in urban and rural areas.

According to the amendment in question, a member may utilise a portion of their accrued benefits to purchase a residential house from an institution.

“A member who wishes to utilise a portion of their accrued benefits to purchase a residential house shall apply in writing to the trustees in the manner prescribed by the scheme,” reads the amendment in parts.

However, a member is only allowed to utilise their accrued benefits once to purchase a residential house under the outlined regulations.

Notably, the amendment published on the Legal Notice 192 of 2020 was signed by the former Treasury Cabinet Secretary, Ukur Yatani, on September 14, 2020.

The court also blocked implementing or enforcing amendments introduced to the Retirement Benefits Act of 1993.

In the Act, the retirement benefits industry was allowed to contribute more to filling the housing gap in Kenya.

Under President William Ruto, a strategic plan was drafted to allow Kenyans to own houses with Ksh6,000 a month mortgage. After 15-25 years, one was expected to be a homeowner.

“For affordable housing, a one-bedroom will go for Ksh6,600 while a two-bedroom will go for Ksh10,000 and that is a mortgage, not rent,” Ruto announced.

Source: kENYANS.CO.KE