In an interview with the Standard on December 18, 2019, the CEO revealed that his journey has been one of great risk and the total lack of fear for failure.

At the current market value, Octagon stood at a market capitalisation of Ksh 100 billion with 200 corporates under management. Which makes it hard to imagine that the company, once started off in a dusty garage.

Octagon Financial Services Chief Executive Office Fred Waswa during an interview in his office in 2019.

The Standard

As a young boy, Waswa had a passion for mathematics and was often advised to pursue Actuarial science.

“I first got involved in pensions in 1985 when my A-level maths teacher pointed out that I was very good at the subject and should consider pursuing Actuarial Science. I knew very little about it, but he convinced me to do the exams and even paid for one exam that I sat that year,” Waswa narrated.

However, after losing his father at the age of 14, the firstborn of eight was raised by a single mother who could not afford the fees required to pursue the course, with the exams alone costing so much.

First job

“I went to university and studied mathematics with a major in statistics at the University of Nairobi,

“For two years, I did underwriting and life assurance and found myself bored to tears looking at files all day. I decided in 1993 to make a move to Fidelity Shield Insurance Company to do pensions,” Waswa recounted.

He had only worked at the company for six months when his boss approached him and told him that he was too bright for the organisation. he had discovered that a lot of actuarial experience was required in pensions, and that fueled his career.

Every assignment he was tasked with, he did on time and diligently, which led to his then-boss seeking a move for him at a much better company.

“He made several calls to get me to Aon Minet, which was the largest administrator explicitly of pensions. I worked till 1996 when Standard Chartered advertised a job opening for a pension administration manager. I told my boss I was interested and he was stunned. He told me that it wasn’t a good idea, having worked at a bank himself before he knew it wasn’t a good fit,” Waswa narrated.

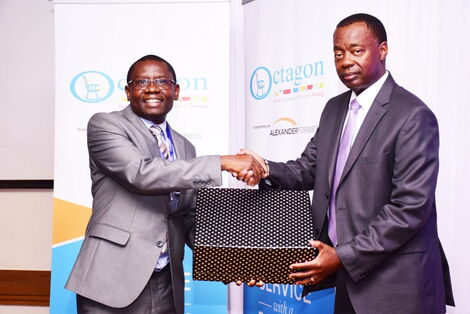

Octagon Africa Group CEO Fred Waswa (right) and Retirements Benefits Authority CEO Nzomo Mutuku (left) during the announcement launch of the strategic business partnership signed between Octagon Africa and Alexander Forbes.

The next step, new job

In 1999, the then finance minister, the late George Saitoti, gave the directive that every insurance company should have an actuary, then a budding professional with a high spirit of adventure and a passion for what he did, Waswa felt he had nothing to lose. He made an application for the job.

Waswa got no response from the company until after the position was advertised afresh, only that on that occasion, it was being outsourced.

“So we applied as a company and StanChart brought people from the UK to vet Minet and other applicants. It wasn’t until months later that we were called for interviews,

“We were seated with my colleagues and other elderly associates in the industry. I knew I wouldn’t get it. The guy chairing the meeting was Mr Roger Urion, Africa’s Pension Manager. He looked at me for a while and then asked where he had seen me,” Waswa recalled.

They had met the previous year when he visited Minet and Waswa had been tasked with showing him around.

Urion had been the MD at the bank for five years and had been deployed to East Africa to restructure pension funds and lucky enough for Waswa, he was in search of an assistant.

“We started working in Zambia and Zimbabwe and Uganda before coming to Kenya. It was the biggest project I ever did, a Ksh6 billion fund with 4,800 members. We finished in December 1999 and in every country, we would outsource the services and retain a principal officer. So I was the principal officer in Kenya,” Waswa narrated.

He was bored with the reduction in workflow and asked Urion for more duties.

“He gave me compensations, a job that only occupied me for a while before I became bored yet again,” he added.

The risk

In 2000, Waswa had become established in pensions, partaking rigorous training to expand his knowledge, which saw him train trustees at the Nairobi Stock Exchange.

At the time, most companies were in search of experts who could educate them on the regulation and restructure of their pension schemes.

“Towards the end of 2000, my boss was about to retire and I was set to replace him as the Africa pensions manager. He was giving me instructions on what to do, but I told him I did not want the job. I was 35, young and full of energy. I did not want to work there until retirement,” Waswa recounted.

He had made up his mind to resign once Urion retired and together establish a consultancy. However, Urion said no to the offer.

Waswa went to the fund’s chairperson.

“I told him how I had worked for the bank for almost four years and I wanted to quit. He applauded my idea but urged me to consider the greater possibility of failure,” Waswa narrated, noting he was confident that even if he failed, he had time to get back up.

“I convinced him to try to change Urion’s mind. I needed Urion’s experience and expertise and would not take ‘no’ for an answer. Urion was adamant about going to Zimbabwe after retirement, but after seeing my passion, he agreed to be a director,” he added.

Waswa went on to register a company and christened it Kingsland Court in honour of Urion’s homeland in the UK.

Octagon Africa Group CEO Fred Waswa (left) and Retirements Benefits Authority CEO Nzomo Mutuku (right) during the announcement launch of the strategic business partnership signed between Octagon Africa and Alexander Forbes.

In 2001, while he had fully decided to resign, Urion told him he was taking a job in Sierra Leone where he would be for three years.

“He asked me if I could wait until the end of that contract before quitting my job. I couldn’t. I was too psyched, but I was not happy because with him gone, I needed funding,

“I resigned when we were getting into the 2002 elections. Economic growth was less than 1 per cent and my employer thought the idea was stupid, asking how I reckoned I would make it. I believed God was going to work for me behind the scenes. Whoever started the bank years ago took a risk and it was fruitful. If that was stupid, then I was willing to try,” Waswa recounted.

“The pension schemes that were knocking on my door earlier would now tell me we’ll have a meeting in September, yet we were in May. I was disheartened. I only had the pay from NSE to fall back on,

“But I was lucky, or rather, blessed enough to work for StanChart from the outside. I was to work two days for the bank and use the three days to work for myself. The three-year agreement started and I was getting Sh60,000 monthly. I tried to bump it up to Sh130,000, but didn’t get it,” he added.

Urion left for Sierra Leone, leaving Waswa with an ultimatum that by the time he was back, and Waswa had failed to add to his clientele, they would call it quits and close shop.

“I spent a week in December at a prayer shrine in Machakos praying for a miracle,” Waswa admitted.

Luckily for him, the payer was not in vain, he landed a second client while still operating from the garage. The initial agreement was for Ksh 300,000, which he later negotiated to Ksh 800,000.

The client had failed to trace money for six months, a job that took Waswa only two days to establish. He was summoned by the client to reveal how he had done it.

“The client, impressed after I exceeded their expectations, paid me Sh2.7 million and gave me a three-year-contract,” Waswa narrated.

Octagon is born

However, in 2006, Waswa had asked Urion if they could move the business that had since expanded from the garage into his unused five-bedroomed home with 21 staffers, and Urion declined, asking Waswa to move alone.

He resigned as executive director and shareholder and in 2007 founded Octagon Pension Services.

In 2016, Waswa founded the Institute of Pension Management to offer training in terms of capacity building for trustees on financial literacy but also for the graduates of actuarial science who know little about pensions. Octagon also offers professional and corporate programmes for employees of organisations.

“We have a very serious problem with people between the ages of 25 and 35. They are knee-deep in debt, and so to get out of the red they leave their jobs to get the pension to pay for the debt. So what we created was first check management, to teach this group how to manage their money. It teaches them not to take loans except for appreciating assets and not for a holiday in Dubai,” Waswa stated.

The company has since grown into Uganda and Zambia and most recently acquired Alexander Forbes stake in Zambia. Waswa stated that his company is looking to expand into several countries in Africa in the near future.

Octagon Africa Group CEO Fred Waswa makes an address during the announcement launch of the strategic business partnership signed between Octagon Africa and Alexander Forbes.