With the Court of Appeal granting the approval of the full implementation of the National Social Security Fund (NSSF) Act No. 45 of 2013, Kenyans will now have to dig deeper into their pockets to pay the monthly deductions.

The move was part of President William Ruto’s social security plan to build a bigger funds pool whereby workers will be paid monthly stipends instead of the one-off payment.

Ruto’s decision elicited mixed reactions among Kenyans who would now be receiving lower salaries following the 10-fold deduction increase.

The minimum monthly deductions, last reviewed in 2001, will now increase from the previous Ksh200 to Ksh2,000.

NSSF Board of Trustees chairman Antony Munyiri, however, released a statement, assuring the public that they would financially secure their future.

“He reiterated that the Fund remains focused on providing the highest standard of service and protection for our member’s contribution. He belives that this decision will bring the NSSF closer to achieving this goal,” the statement read in part.

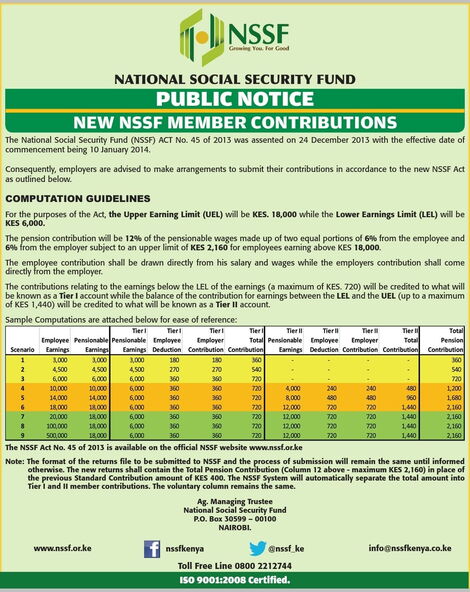

Kenyans.co.ke looks at the computation guidelines based on an employee’s salary scale.

Earning Limits

According to the NSSF Act, the Upper Earning Limit (UEL) are for employees who earn Ksh18,000 and above, while the Lower Earning Limit (LEL) is for those who earn below Ksh6,000.

In addition, the pension contribution is calculated as 12 per cent of the pensionable wages, a sum of equal portions from both the employee and employer. The employee contribution is deducted directly from the salary, while the employer’s contribution comes directly from the employer.

According to the figure above, employees earning between Ksh3,000 and Ksh6,000 will pay contributions in the Tier 1 category only. In contrast, those in the UEL category will contribute to the Tier 1 and 2 categories.

Tier 2 is calculated as the contribution balance for earnings between Ksh6,000 and Ksh18,000.

Those earning above Ksh10,000 will pay in both Tier 1 and Tier 2 categories. This means that their computation is calculated as a result of Tier 1 total contribution and Tier 2 total contribution.

For employees earning between Ksh3,000 and Ksh4,499, the amount of their monthly deduction to Ksh360.

Employees earning between Ksh4,500 and Ksh5,999, their contributions are Ksh540 and employees earning between Ksh6,000 and below Ksh10,000 will pay Ksh720.

Those getting above Ksh10,000 and below Ksh14,000 will remit Ksh1,200 monthly, while those earning between Ksh14,000 and Ksh17,999 will pay Ksh1,680.

Those earning above Ksh18,000 will pay a monthly contribution of Ksh2,160.

Source: kENYANS.CO.KE